Latest post

Parafin, a San Francisco-based fintech startup specializing in embedded finance infrastructure, announced a successful close of a $100 million Series C funding round that has pushed its valuation up to $750 million.

This investment is led by Notable Capital with participation from Redpoint Ventures and existing investors Ribbit Capital, Thrive Capital, and GIC. Such a massive investment speaks about the key role that Parafin is playing to transform financial services for small businesses through strategic partnerships with major platforms.

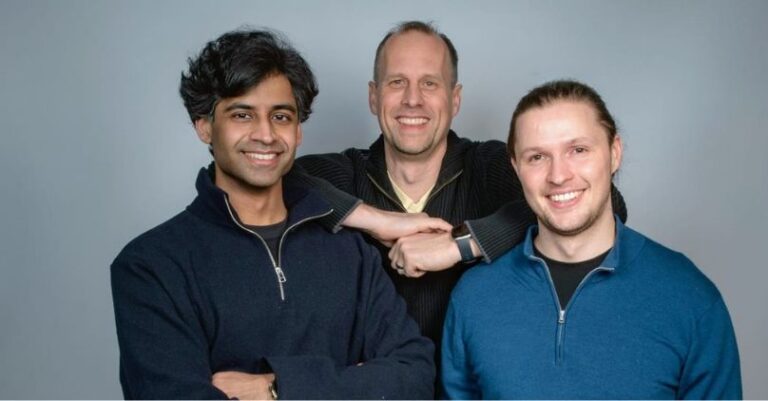

Founders and Founding Year

Parafin was established in 2020 and was founded by three former employees of Robinhood.

Sahill Poddar: CEO Sahill Poddar was formerly Head of Machine Learning at Robinhood, bringing deep expertise in data science and financial technology.

Ralph Furman: President Ralph Furman was a data scientist at Robinhood, bringing a strong background in data analytics and financial modeling.

Vineet Goel: The Chief Product Officer, Goel led earlier Risk and Fraud Engineering at Robinhood. The team has deep insights in both risk management and product development.

Their collective experience in fintech and shared vision to empower small businesses by making financial services more accessible led to the launch of Parafin.

About Parafin:

Parafin provides embedded financial products to platforms that support small businesses, essentially abstracting away all the complexities of capital markets, underwriting, servicing, compliance, and customer support. Parafin allows the platform to offer financial services directly to its small business clients for easy access to capital and financial tools to support growth and sustainability.

Empower small businesses to grow and be resilient with the seamless access of financial services through embedded finance solutions.

Become the leading provider of embedded finance infrastructure, enabling platforms worldwide to offer comprehensive financial services to their small business clients.

Core Offerings

Embedded Financial Products: The infrastructure of Parafin enables the integration of capital advances, spend management, and savings tools into the ecosystems of platforms to provide tailored financial solutions for small businesses.

Seamless Integration: With one integration, a platform can launch an entire suite of financial products, making the process smoother for both the platform and the end-users.

Data-Driven Underwriting: Using real-time performance data and cutting-edge machine learning models, Parafin assesses eligibility and provides personalized financial solutions in a manner that goes far beyond credit scores and personal guarantees.

Recent Funding and Growth

The $100 million funding round, Series C funding round, announced on 17 December 2024 marks a very important point in the trajectory of the growth of Parafin. Led by Notable Capital, this round involves massive participation from Redpoint Ventures and existing investors as it brings Parafin’s valuation to $750 million.

Since the Series B round in September 2022, Parafin has seen incredible growth. Volumes have risen by 400%. The company now funds nearly $1 billion annually for tens of thousands of small businesses across the U.S. and Canada and expects to break even within six months.

Strategic Partnerships

Parafin’s infrastructure powers financial services for a diverse range of platforms, including global leaders such as Amazon, Walmart, DoorDash, TikTok, and Worldpay. These partnerships enable platforms to offer their small business sellers access to capital and financial tools, fostering growth and operational efficiency.

Utilization of Funds

- Scale Existing Products: Enhance and expand current offerings to better serve small businesses and platform partners.

- Develop New Products: Innovation and introduction of new financial solutions that cater to the needs of small businesses as they change.

- Geographical Expansion: Expansion into new markets that increase the reach and influence of Parafin’s solutions.

Impact on Small Businesses

Parafin addresses several challenges of small businesses by providing platforms with the tools to offer embedded financial services.

More equal and easier access to loans, especially for small, underserved businesses in local community

Financial solutions meant to help business owners navigate their operations, with most of the time to scale and engage with their customer base.

Customized solutions: Provides financial solutions focused on the needs of individual clients and performance metrics for optimal relevance and effectiveness.

With the significant infusion of capital and a clear strategic vision, Parafin is ready to continue on its path of rapid growth and innovation. The company’s focus on empowering small businesses through embedded finance solutions makes it a transformative force in the fintech landscape, potentially redefining how small businesses access and use financial services in the years ahead.

Pingback: Anatomy Financial Secures $19M to Revolutionize Healthcare Payment Processing

Pingback: Alif has secure $20m debt investment from Accial Capital