Latest Post

2025-02-05

Latest Post AI Trace.Space Raises $4M to Transform Engineering with AI Magic 2025-02-05 Startups PartsCloud...

2025-02-05

Latest Post Startups PartsCloud Raises €5M to Revolutionize Spare Parts Management 2025-02-05 AI Google...

2025-02-05

Latest Post Blog Google Unveils Gemini 2.0: Boosting AI with Superior Reasoning 2025-02-05 saas Protex...

2025-02-05

Latest Post saas Protex AI Raises $36M to Enhance Worker Safety at Amazon, Tesla, and Beyond 2025-02-05...

2025-02-05

Latest Post fintech Neofin Raises $7M to Transform Accounts Receivable in Brazil 2025-02-05 vc Hitachi...

2025-02-05

Latest Post vc Hitachi Ventures Launches $400M Fund to Drive Innovation in AI, Energy, and Life Sciences...

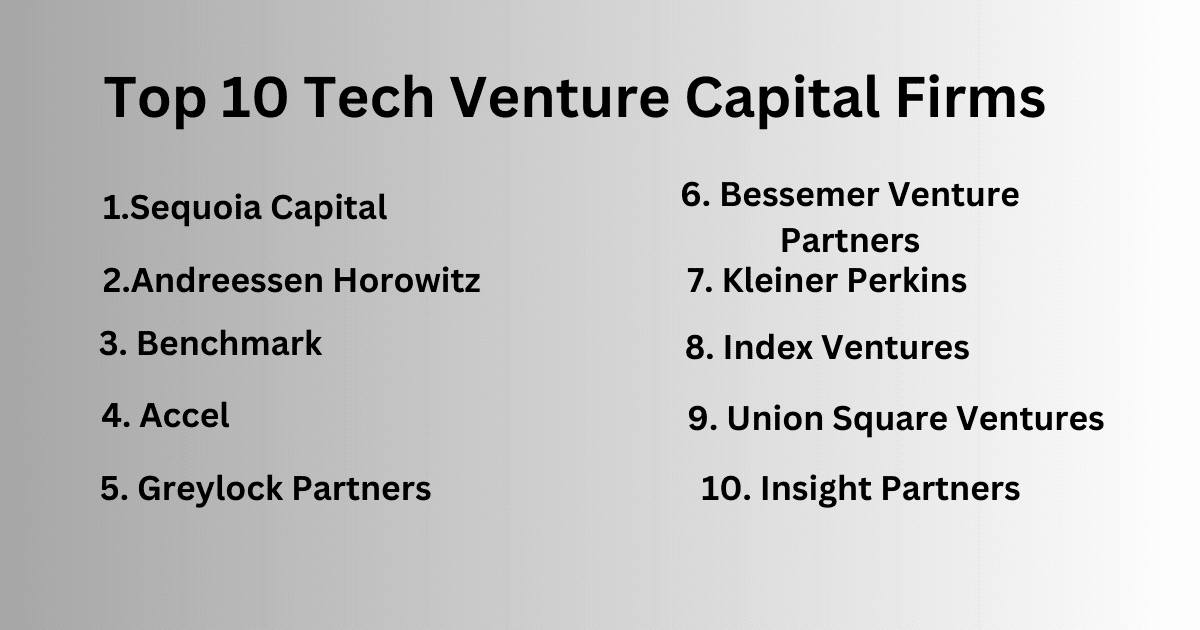

Venture capital (VC) firms play a pivotal role in the startup ecosystem, providing funding and resources to innovative companies, especially in the tech space. Here’s a detailed look at the top 10 VC firms that are actively investing in early-stage tech startups, their minimum investment requirements, and what they look for in potential investments.

1. Sequoia Capital

- Overview: Sequoia Capital is one of the most renowned venture capital firms in the world. Founded in 1972, it has backed some of the most successful tech companies, including Apple, Google, and Airbnb.

- Minimum Investment: Typically, Sequoia invests $1 million to $5 million in early-stage startups.

- Stage Focus: Sequoia focuses on seed, Series A, and later-stage investments.

- Key Focus Areas: SaaS, enterprise software, fintech, artificial intelligence (AI), and consumer tech.

- Why Sequoia?: Sequoia provides deep expertise, strategic guidance, and access to a large network, making it a top choice for early-stage startups.

2. Andreessen Horowitz (a16z)

- Overview: Founded in 2009 by Marc Andreessen and Ben Horowitz, Andreessen Horowitz (a16z) is a leading VC firm known for investing in groundbreaking tech startups.

- Minimum Investment: The firm generally invests $500,000 to $10 million in early-stage companies.

- Stage Focus: Seed to Series B funding.

- Key Focus Areas: Software, blockchain, fintech, biotech, and consumer internet.

- Why a16z?: Andreessen Horowitz is known for its strong operational support and network, which provides startups with resources beyond just funding.

3. Benchmark

- Overview: Benchmark is another highly influential VC firm, with a track record of successful investments in companies like Uber, Twitter, and Snap.

- Minimum Investment: Benchmark typically invests $1 million to $5 million in early-stage ventures.

- Stage Focus: Primarily seed and Series A.

- Key Focus Areas: Mobile applications, software, consumer services, and cloud computing.

- Why Benchmark?: Known for its hands-on approach and small, tightly-knit team that offers more personalized support to portfolio companies.

4. Accel

- Overview: Accel is one of Silicon Valley’s top-tier venture capital firms. Founded in 1983, it has invested in over 300 companies, including Facebook, Dropbox, and Slack.

- Minimum Investment: Typically, Accel invests $1 million to $10 million in early-stage startups.

- Stage Focus: Seed, Series A, and Series B investments.

- Key Focus Areas: Software, mobile, fintech, and enterprise technology.

- Why Accel?: Accel is known for its global reach and deep industry expertise, making it an excellent choice for tech startups aiming to scale quickly.

5. Greylock Partners

- Overview: Founded in 1965, Greylock Partners has a long history of backing successful companies such as LinkedIn, Airbnb, and Dropbox.

- Minimum Investment: Greylock typically invests $1 million to $5 million in early-stage startups.

- Stage Focus: Seed, Series A, and growth stages.

- Key Focus Areas: Consumer internet, AI, cloud infrastructure, and enterprise software.

- Why Greylock?: Greylock’s team includes some of the most influential figures in Silicon Valley, offering unparalleled mentorship and strategic insight.

6. Bessemer Venture Partners

- Overview: Bessemer Venture Partners is one of the oldest venture capital firms in the U.S., with a history dating back to 1911. It has invested in companies such as Pinterest, LinkedIn, and Shopify.

- Minimum Investment: Bessemer invests $500,000 to $10 million in early-stage startups.

- Stage Focus: Seed, Series A, and Series B.

- Key Focus Areas: SaaS, cloud computing, fintech, and health tech.

- Why Bessemer?: Bessemer is known for its deep industry knowledge and long-term partnership approach, providing startups with the tools to grow and scale.

7. Kleiner Perkins

- Overview: Kleiner Perkins has been a major player in the VC world for over 40 years. The firm has invested in companies like Google, Amazon, and Twitter.

- Minimum Investment: Kleiner Perkins generally invests $1 million to $5 million in early-stage startups.

- Stage Focus: Seed to Series A and beyond.

- Key Focus Areas: Green tech, consumer tech, digital health, and SaaS.

- Why Kleiner Perkins?: Kleiner Perkins is highly respected for its early-stage investments and for nurturing high-impact innovations in the tech space.

8. Index Ventures

- Overview: Index Ventures is a global VC firm with offices in London, San Francisco, and Geneva. It has backed companies like Skype, Dropbox, and SoundCloud.

- Minimum Investment: Index Ventures typically invests $500,000 to $10 million in early-stage ventures.

- Stage Focus: Seed to Series B.

- Key Focus Areas: SaaS, e-commerce, fintech, and health tech.

- Why Index Ventures?: Index offers a strong international network and is particularly known for supporting global expansion and innovation.

9. Union Square Ventures (USV)

- Overview: Union Square Ventures is one of the most prominent early-stage VC firms in New York, with investments in Twitter, Etsy, and Coinbase.

- Minimum Investment: USV invests $500,000 to $5 million in early-stage startups.

- Stage Focus: Seed and Series A investments.

- Key Focus Areas: Social media, consumer internet, fintech, and blockchain.

- Why USV?: USV is known for its deep commitment to building long-term relationships with entrepreneurs and helping them scale through strong operational support.

10. Insight Partners

- Overview: Insight Partners is a leading growth-stage VC firm that invests in tech startups across various industries. Its portfolio includes companies like Twitter, Wix, and Shopify.

- Minimum Investment: Insight Partners typically invests $2 million to $20 million in early-stage and growth-stage startups.

- Stage Focus: Primarily Series B and beyond, though they occasionally participate in Series A rounds.

- Key Focus Areas: SaaS, AI, cloud computing, and enterprise software.

- Why Insight Partners?: Insight offers a unique blend of capital and operational expertise, helping startups scale through data-driven insights and strategic guidance.